Epic ERP: The Next Major Disruptor?

At this year’s Epic User Group Meeting (UGM), Epic announced progress on its development of a native, healthcare-focused ERP designed to work seamlessly with the Epic EHR. This builds on the initial conversations shared at HIMSS 2025 and signals Epic’s intent to reduce reliance on external integrations by offering an all-in-one operational platform.

Functional Roadmap

Epic’s ERP is expected to roll out in phases, with functionality spanning three primary domains:

• Workforce Management: Time & Attendance, Credentialing, Staffing & Scheduling, Payroll, Human Resources

• Supply Chain / Materials Management: Inventory Management, Procurement, Vendor & Contract Management, Product Catalog

• Financials: General Ledger, Cost Accounting, Budgeting, Accounts Payable

Timeline

While development is active, the full maturity of Epic’s ERP remains years away. Early adopters may see incremental functionality sooner, but industry estimates suggest 2027 at the earliest for a product robust enough to meaningfully support health system operations. Full depth across all domains will likely take longer.

Market Context

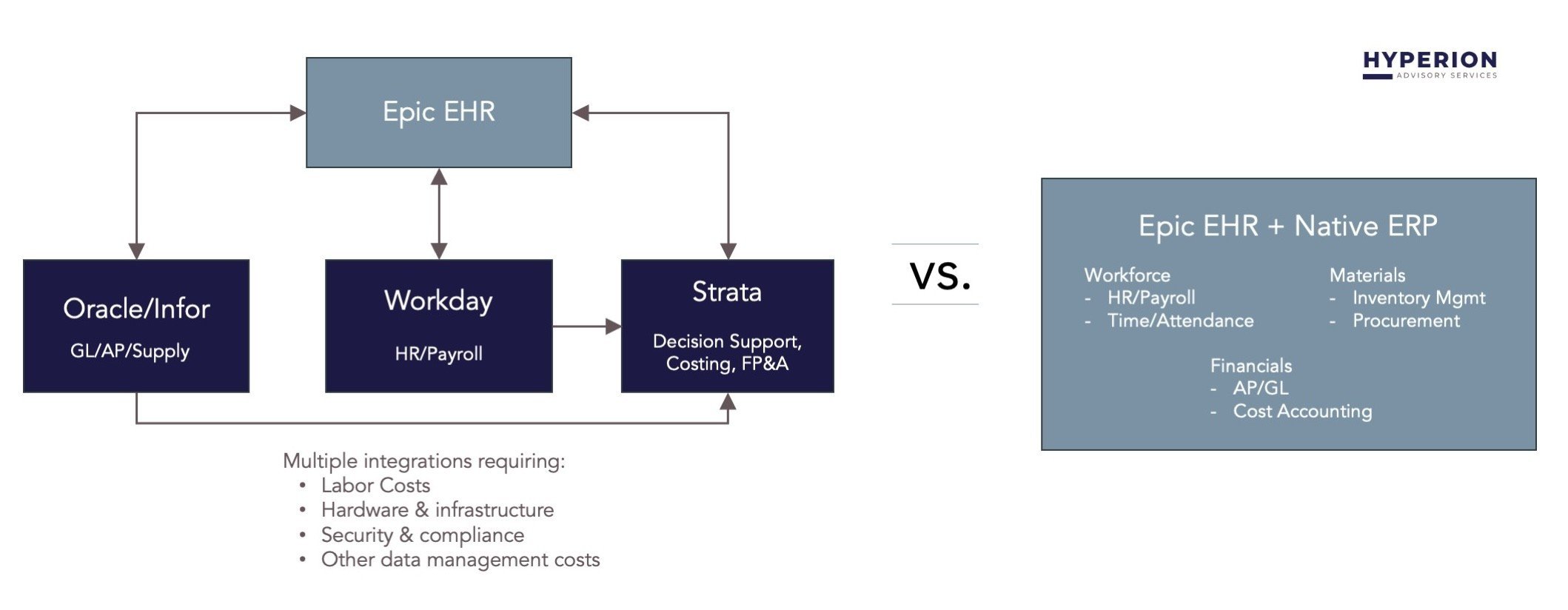

Today, most health systems pair Epic’s EHR/Financials with either a single external ERP (such as Oracle, Workday, or Infor) or a combination of ERP solutions and then supplement with Strata or another decision support platform for costing, advanced financial planning, and performance analytics.

Multiple integrations versus Epic utilizing Native ERP

Pros of the Current Model:

• Best-of-breed depth in Finance, Supply Chain, and HCM

• Strata enhances cost accounting, budgeting, and margin insights

Cons of the Current Model:

• Multiple vendor contracts

• Complex integrations (EHR ↔ ERP ↔ Strata)

• Higher IT overhead and potential data latency

In contrast, Epic’s native ERP model reduces interfaces and promises tighter alignment between clinical, financial, and workforce data.

Pros of the Native Epic ERP:

• Fewer interfaces → lower IT burden

• Shared data model across care delivery and operations

• Potentially smoother end-user experience

Cons of the Native Epic ERP:

• Modules are still maturing

• Depth may not yet match Oracle, Workday, or Infor in core Finance/SCM

• Limited advanced cost accounting (organizations may still need Strata or similar solutions)

Bottom Line

Epic’s ERP push underscores a clear strategic direction: reduce vendor sprawl and integration complexity for Epic-first organizations. For now, established ERP players continue to provide deeper functionality and mature toolsets in Finance, Supply Chain, and Analytics. But over time, health systems may see value in the simplified architecture and lower interface maintenance that Epic’s ERP could deliver.

The solution won't solve any immediate needs, but its future trajectory should be factored into any long-term ERP planning. Organizations evaluating ERP options in the next 2–3 years will need to weigh proven functionality against Epic’s promise of a tightly integrated platform.